Governments? Bitcoin? Trump or Dump Crypto Agenda: We'll See What Happens Next

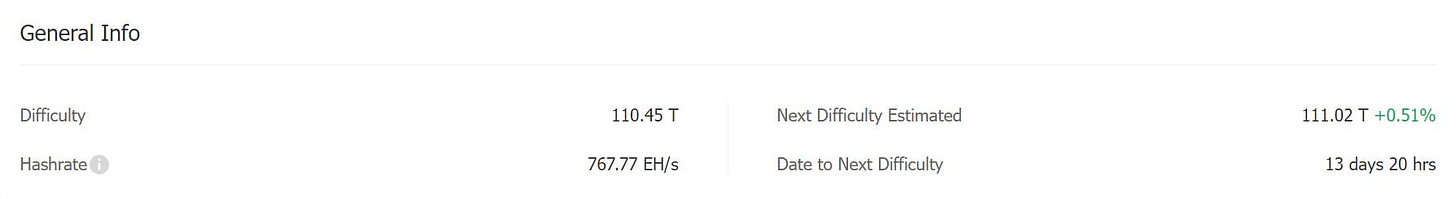

🌤️ Release W3'25 | 879,647 | Bitcoin Breaks $102K, Mining Hits Record 110.45T Difficulty, and Trump Teases a Crypto Executive Order, while Governments FOMO in the Trump Crypto Agenda.

👀 TLDR 🪟

Buckle up—Bitcoin’s week was a wild ride with dips and rebounds!

Bitcoin kicked off the week at $90K and reclaimed $105K by Friday.

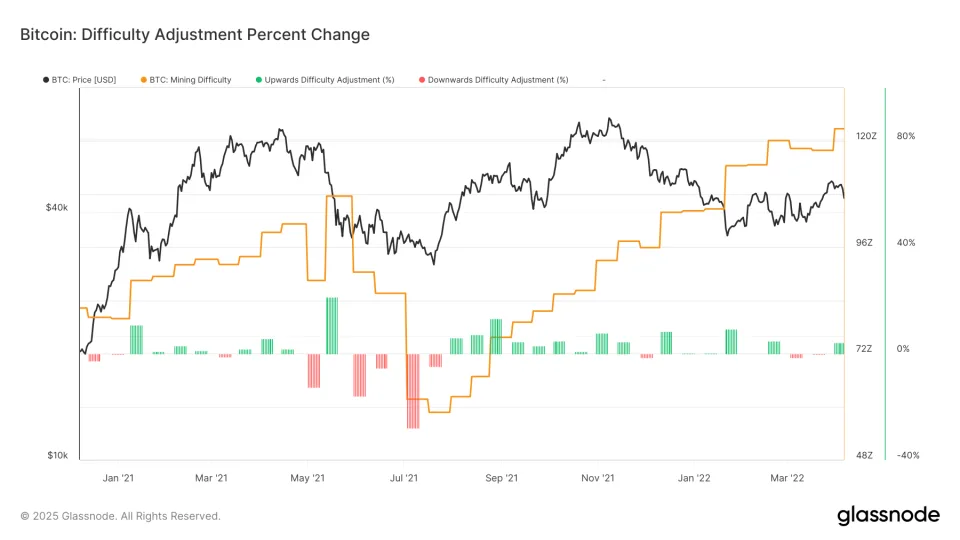

We love this Epoch: Bitcoin’s mining difficulty hits a record high of 110.45 T, but Hashprice is almost back over the $60/PH/day mark.

Gryphon Digital Mining acquires $18.7M site; BitFuFu adds 50MW+ in Oklahoma; Bitmain moving 2024 S19 XP Hosting craze; Russia’s mining equipment demand grew 3x despite regional bans.

Texas may create Bitcoin reserve; Kenya legalizes Bitcoin; Meta wants Bitcoin in reserves; Tether moves to El Salvador; ; Osprey aims for Bitcoin ETF; Thailand’s SEC explores Bitcoin ETFs; Malaysia’s PM calls for BTC exploration; North Dakota proposes Bitcoin treasury; New Hampshire considers Bitcoin Reserve Bill; SEC must explain rejection; U.S. to return 94,643 BTC from Bitfinex.

Intesa Sanpaolo buys BTC; Remixpoint buys 33.34 BTC; LQWD holds 148 BTC; Matador buys 29 BTC; Genius adds 372 BTC; Ming Shing buys 500 BTC; Semler buys 237 BTC.

Trump to issue a crypto executive order on day one.

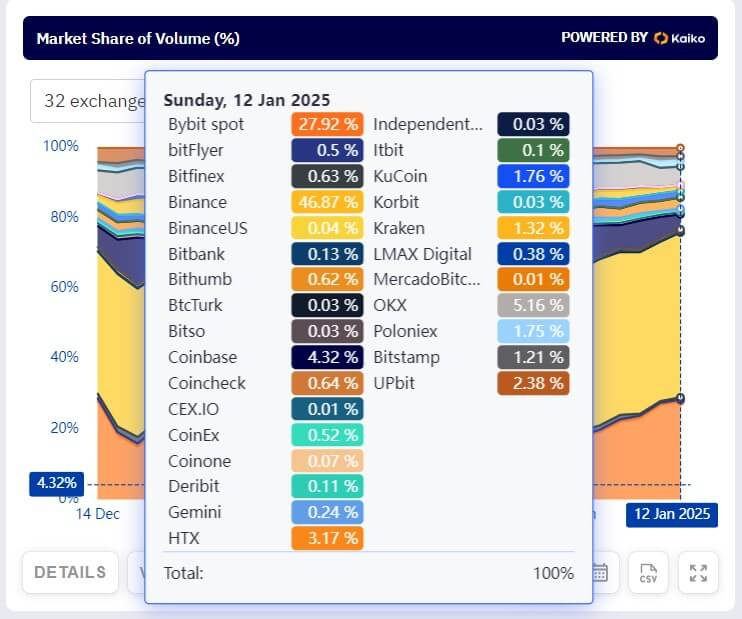

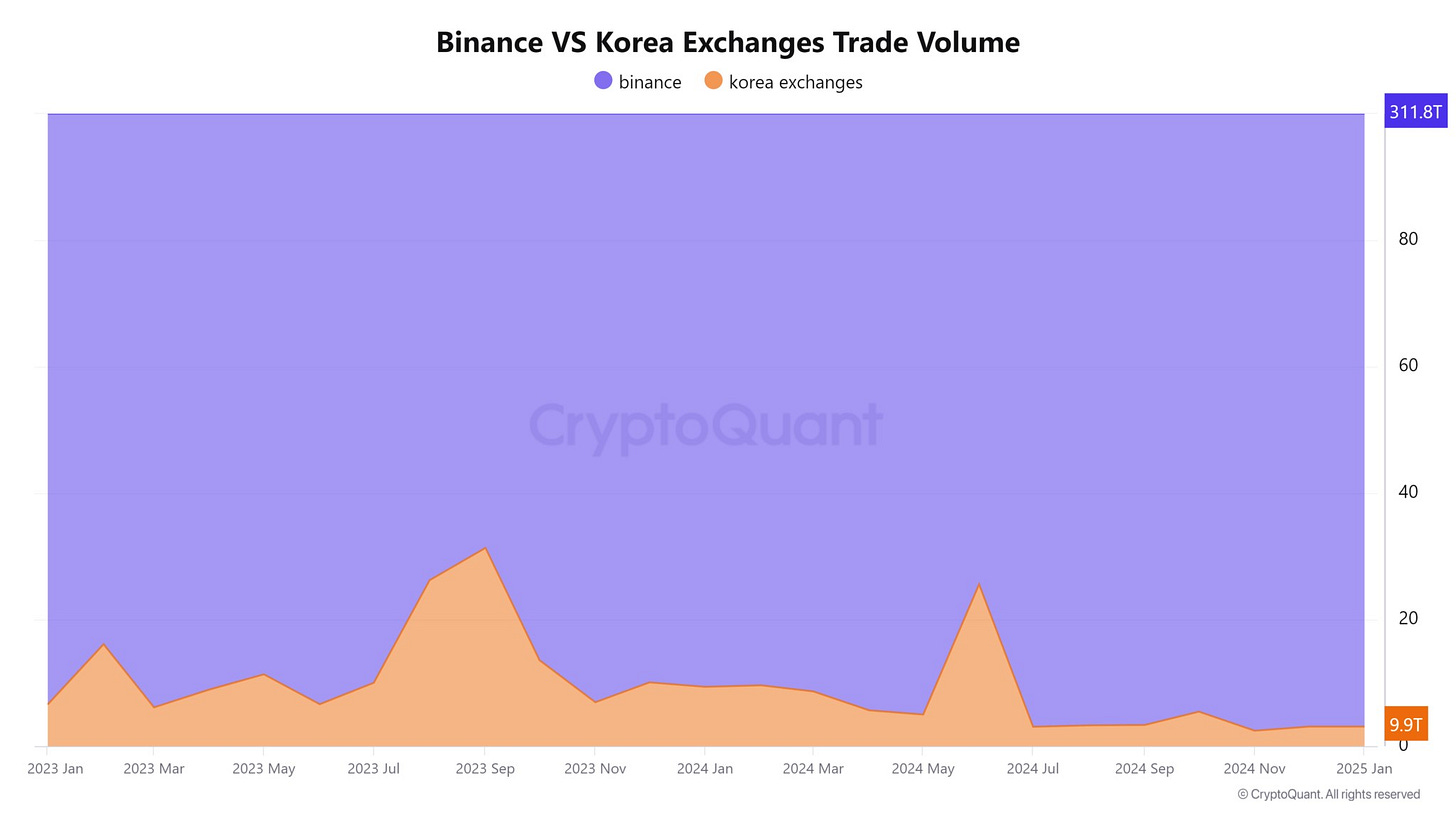

Binance holds 97% of South Korea's market, half of global Bitcoin transactions.

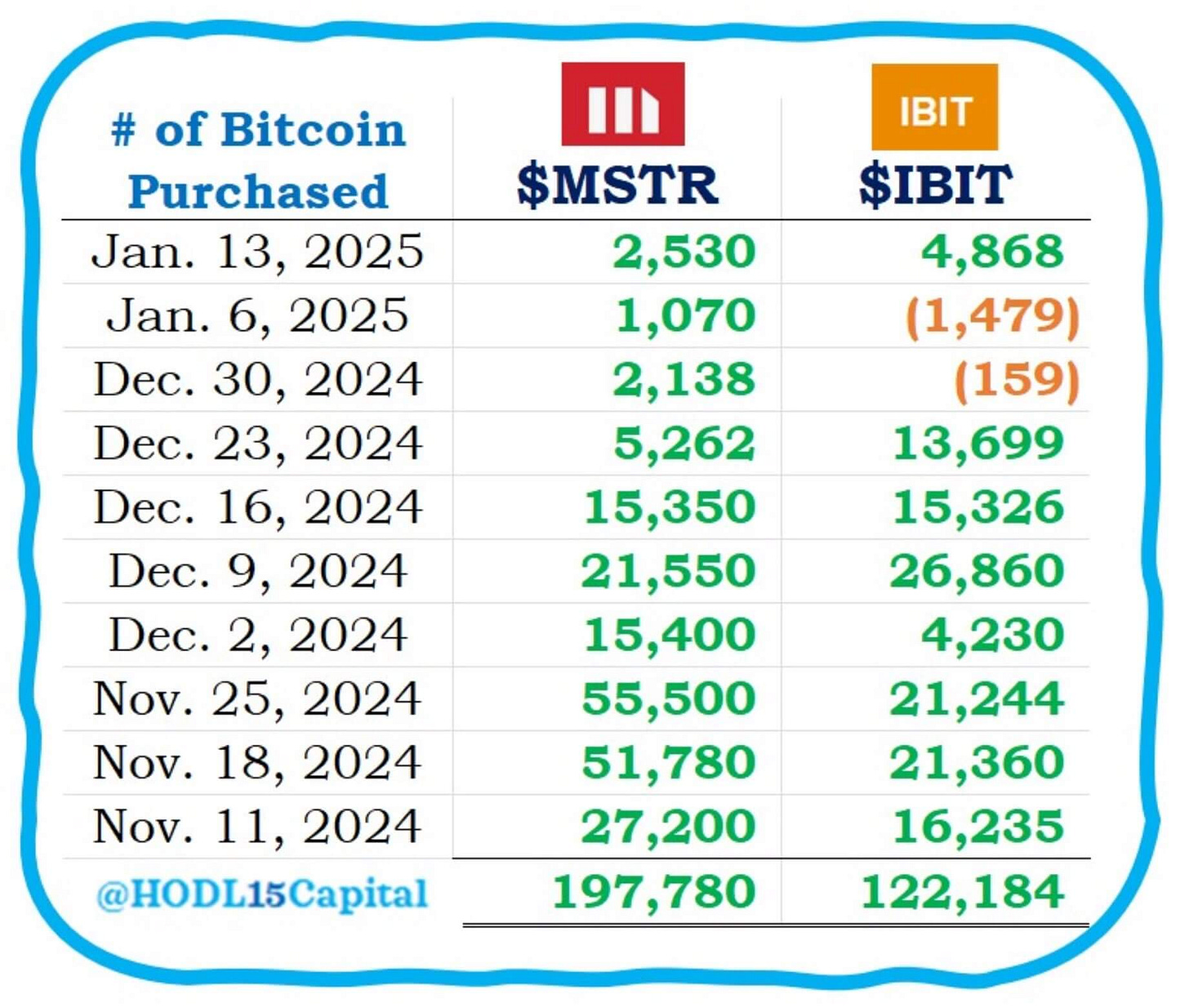

MicroStrategy outpaces BlackRock’s IBIT in Bitcoin buying.

Could inflation continue to push Bitcoin’s price higher?

✨ Hash & Cash Index 🚀

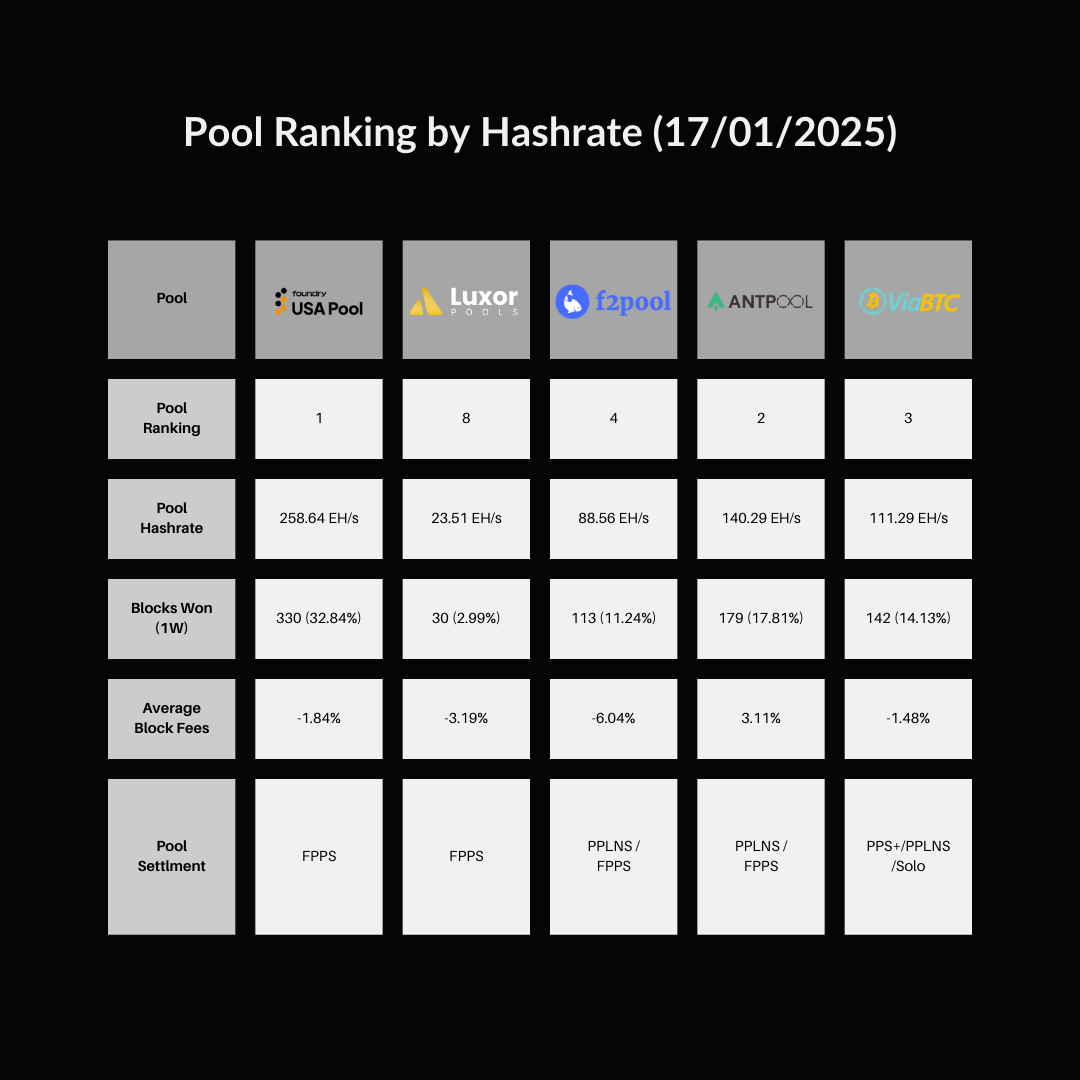

🪄 Pool Power Tools 🎱

⚡Auradine AT2880 achieves 17.5 J/TH efficiency, matching Antminer S21 in a test.

⛏️ Ionic Digital mined 1,851 BTC in 2024, with a December hashrate of 8.563 EH/s.

🧰 Hard-Ware & Hosting Index ⚙

⚡Gryphon Digital Mining announces $18.7M site acquisition from a Canadian oil and gas company.

💡 BitFuFu to acquire majority stake in 51 MW Bitcoin mining facility in Oklahoma.

🔥 Bitmain is selling hosted S19XP Hydro miners for $2,313 each, with a $0.10/kWh fee.

🇷🇺 Russia sees a threefold rise in demand for industrial mining equipment and services in Q4 2024.

📈 Seven in ten publicly traded bitcoin mining companies are off to a strong start in 2025, with Riot Platforms leading the charge.

🔝Bitmain and Microbt are leading manufacturers in the ASIC bitcoin mining industry, offering a variety of miners suited for individual buyers and hobbyists. Their air-cooled models are more accessible to casual miners compared to the complex hydro and immersion-cooled alternatives.

Here are the key details of their miners:

🌟 If you are interested in hosting or purchasing ASICs please use this link to see how much more BTC you can mine and less USD to spend. Fill out this survey so we can beat the halving together or email info@onmine.io.

🔆 Join more than 1,000 miners and upgrade your Bitcoin Mining Game here:

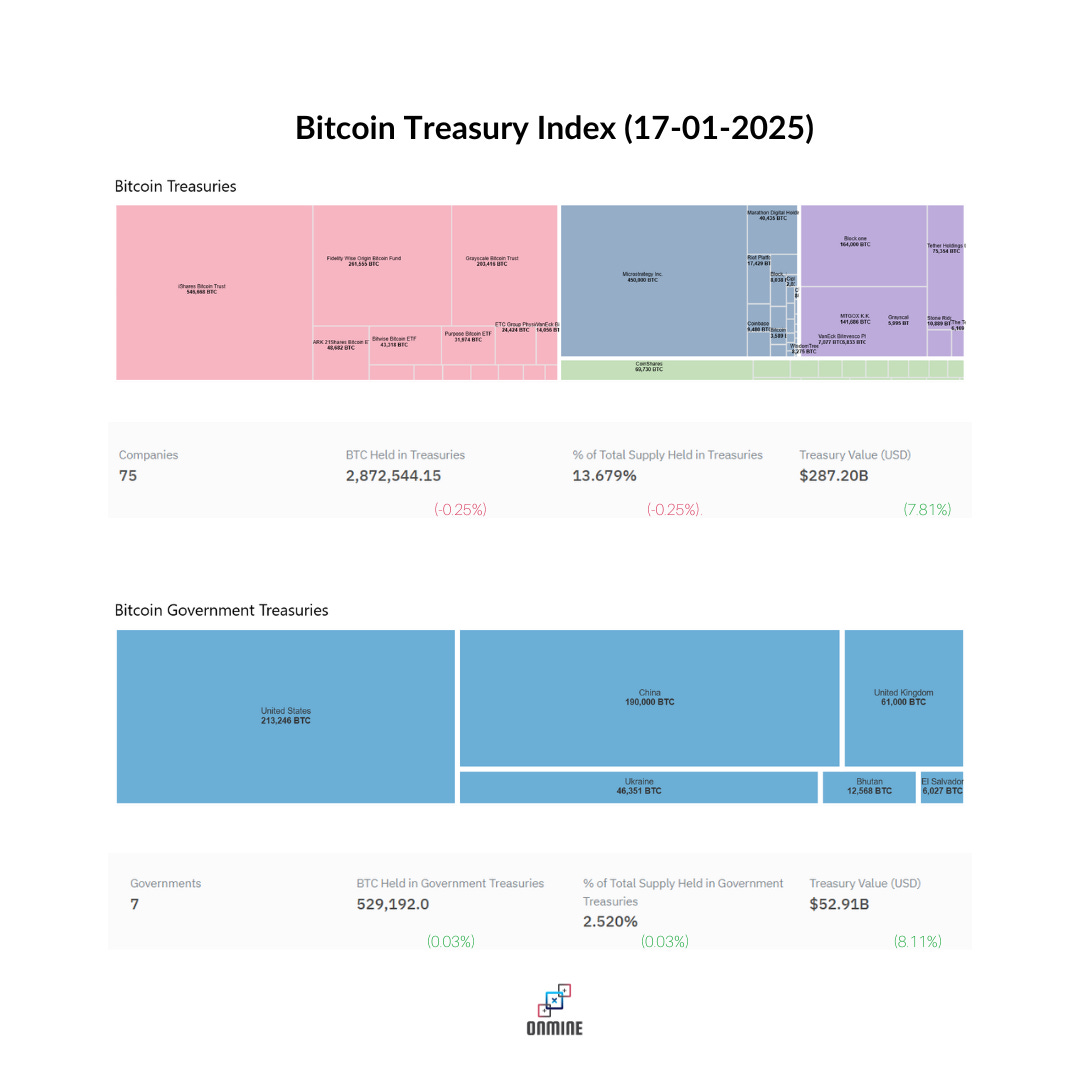

🏦 Bitcoin Products 🔍

🚨 President-elect Trump is set to issue a crypto executive order on day one.

🚀 Trump’s administration plans to appoint 24 CEOs and founders to a crypto advisory council.

🇺🇸 Texas could become the first state with a strategic Bitcoin reserve under Senate Bill No. 778.

🇰🇪 Kenya to legalize Bitcoin trading.

🇺🇸 North Dakota lawmakers propose adding Bitcoin to the state treasury.

🇺🇸 New Hampshire proposes Strategic Bitcoin Reservice Bill.

🇸🇻 Tether moves its headquarters to El Salvador.

🇨🇦 iShares launches Bitcoin ETF on Cboe Canada, trading under IBIT and IBIT.U.

🇯🇵 Metaplanet unveils Bitcoin Magazine Japan to engage 1M Japanese to Bitcoin.

🇮🇹 Italy's largest bank, Intesa Sanpaolo, invests in Bitcoin, buying 11 BTC for €1M.

🇯🇵 Remixpoint, a Japanese energy consulting firm, has acquired 33.34 BTC for 500 million yen ($3.2 million).

🇨🇦 LQWD Technologies has acquired 7 more Bitcoin, bringing its total to 148 Bitcoin.

🇨🇦 Matador Technologies has purchased 29 Bitcoin for CAD$4.5 million.

🇲🇾 Malaysia’s PM calls for the central bank and treasury to explore Bitcoin and crypto “to ensure we’re not left behind.”

🇧🇹 Bhutan government moved 633 BTC, igniting market buzz.

🇹🇭 Thailand’s SEC is exploring the launch of spot Bitcoin ETFs on local exchanges for the first time.

🍁 Goodfood Market, the Montreal-based Canadian grocery and meal provider, adds Bitcoin to its reserves

🚨 Meta shareholders urge adding Bitcoin to its $72B reserves to combat inflation.

💥 Semler Scientific adds 237 Bitcoin for $23.3M.

⚖️ Tether has filed a lawsuit against Swan Bitcoin, alleging "significant breaches" of their agreements.

💼 Heritage Distilling, a craft distillery from the Pacific Northwest, reveals a Bitcoin policy to hold BTC and accept it as payment.

💰 Alpen Labs raises $8.5M to develop Bitcoin ZK Rollup Strata, launching in 2025.

🚨 Osprey Funds plans to turn its Bitcoin Trust into an ETF after the Bitwise deal fell through.

💰 Genius Group acquires $5M in Bitcoin, increasing holdings to 372 BTC.

💼 Ming Shing Group, a Hong Kong company, buys 500 Bitcoins for $47M.

📈 BlackRock’s Bitcoin ETF Options now make up 50% of Deribit’s BTC open interest.

⚖️ The US SEC must “explain itself” for denying Coinbase’s request on crypto regulations, says court.

🏛️ U.S. attorneys filed to return 94,643 BTC and forked assets to Bitfinex from the 2016 hack.

🇺🇸 Trump considers XRP, USDC, and Solana for a U.S. crypto reserve.

👩💼 Senator Lummis questions U.S. Marshals' Bitcoin sale plans.

🔗 Coinbase partners with Morpho for Bitcoin-backed USDC loans.

🔍 Aave tokenholders eye Bitcoin mining to grow revenue and expand GHO adoption.

🎬 End Notes 🎤

🪙 MicroStrategy is unstoppable in its Bitcoin buying momentum, adding $243M worth of BTC, surpassing 450,000 BTC holdings valued at $41B. For 10 weeks straight, they've stacked nearly 200,000 BTC, outpacing BlackRock’s IBIT!

💰 Over 750 dormant bitcoins, worth $71.8 million, have reentered circulation during the first 12 days of January 2025, as Bitcoin trades 12% below its peak, with notable movements from wallets dating back to 2011-2017.

🌐Binance holds 97% of South Korea's market share and processes half of global Bitcoin transactions.

🚀 Bitcoin’s mining difficulty hit an all-time high of 110.45 trillion! It’s now 110.45 trillion times harder to mine a block than when Bitcoin started.With 8 consecutive positive adjustments, miners are feeling the heat!

🚀Bitcoin’s correlation with the Nasdaq has also been on the rise, with both markets impacted by global economic factors like rising yields and a stronger US Dollar.

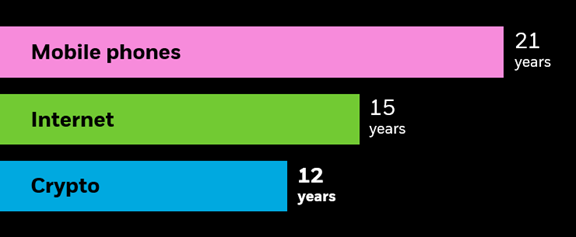

🚀 Since its 2009 launch, Bitcoin has seen adoption rates faster than the internet and mobile phones, driven by digital-native younger generations, global economic shifts like inflation and political divides, and the evolving digital economy reshaping finance with accessible infrastructure and new use cases.

Time needed to achieve 300 million users

🏆 Examining the trends from last year, almost every major asset showed positive growth, except long-duration Treasuries. Bitcoin held the #1 position for the second straight year—having only ever had 3 down years in its history—will it stay at the top in the future?

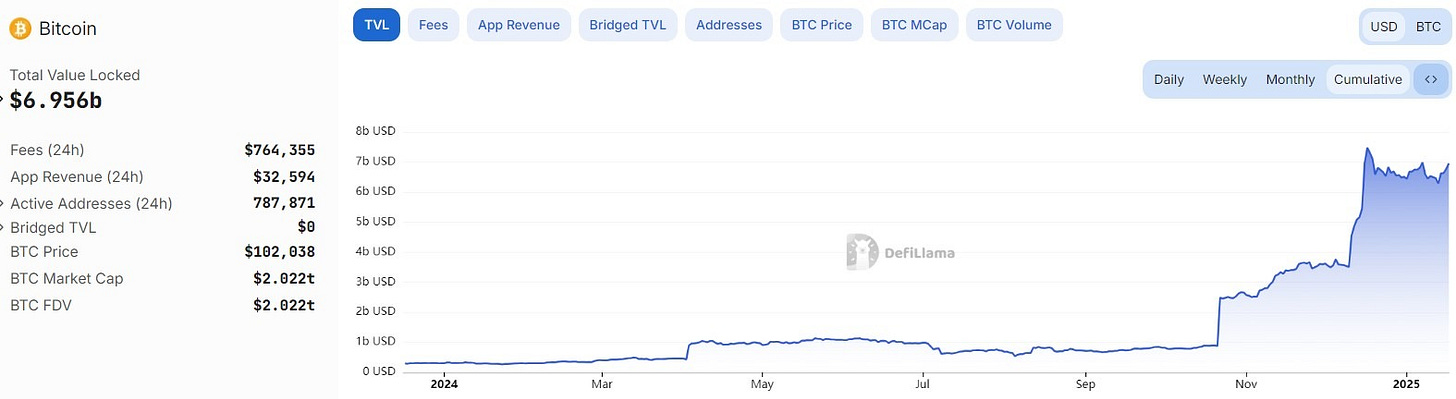

📈 Bitcoin-based DeFi (BTCFi) saw explosive growth in 2024, with its total value locked (TVL) soaring 2,000% from $307 million in January to over $6.5 billion by December. This surge was driven by the rise in Bitcoin prices post-April halving and key developments in Bitcoin staking, especially with Babylon, which now holds more than 80% of BTCFi’s TVL.

🌍 "From El Salvador’s streets to the corridors of global finance, Bitcoin is steadily making its way into national reserves. Are we witnessing the dawn of a new financial era, or merely a modern-day gold rush?

As Bitcoin gains traction as a potential reserve asset, countries such as El Salvador, the U.S., Brazil, and Russia are leading the charge in exploring its integration into their sovereign reserves. Across five continents, including Switzerland, Poland, and South Africa, nations are now eyeing Bitcoin as a safeguard against currency volatility. While concerns about its volatility persist, the growing support for Bitcoin suggests it could play a significant role in transforming the future of global finance.

🪙After battling some tough bearish pressure around the $90,000 mark, Bitcoin has powered through the storm and is back above the coveted six-figure territory!

What sparked this sudden rise? The U.S. Bureau of Labor Statistics dropped a big bombshell: consumer prices for December 2024 shot up by 0.4%, bringing the annual Consumer Price Index (CPI) to 2.9%. But that’s not all – core inflation (excluding the usual suspects like food and energy) jumped by 3.2% year-over-year, and 0.2% on a monthly basis. Analysts predicted this, but the real kicker is the 0.3% uptick in prices for services (minus housing and energy), which has added more fuel to the fire of persistent inflation concerns.

Though another correction is still possible, overall market sentiment is positive, with many anticipating that Donald Trump’s upcoming inauguration and the start of his presidency could have a significant impact on the future of cryptocurrencies.

🤑 Top Tea 🫖

These six non-crypto firms are copying MicroStrategy and gobbling up Bitcoin - DL News

Japan, South Korea, and the US issue joint warning over North Korea-related crypto thefts - Cryptoslate

3 reasons why 2025 is set to be another blockbuster year for Bitcoin and crypto sector - Cointelegraph

Trump's return to Washington kicks off flurry of crypto-related activity, IRS challenges and focus on crypto debanking - The Block

Bitcoin Briefly Slides Below $90K, MicroStrategy Buys More - Yahoo Finance

Will This Week’s CPI Figures Keep Bitcoin on Track to $200,000? - Decrypt

Bitcoin poised to dip further as inflation looms: Steno Research - Cointelegraph

Bitcoin risks consolidation as Treasury yields surge and economic outlook dims – Bitfinex - Cryptoslate

Departing SEC Chair Gary Gensler Slams Crypto Again—But Says Bitcoin Is Different - Decrypt

Bitcoin and stocks have been moving in sync: Morning Brief - Yahoo Finance

Bitcoin holds near $96,500 as US PPI data shows slower producer price growth - Cryptoslate

Eight U.S. Blockchain Lobby Groups Unite Ahead of Trump's Crypto Friendly Regime- Coindesk

MicroStrategy's preferred MSTR issuance seeks 'returns and volatility' at 1.5x bitcoin, Saylor says - The Block

Mining Bitcoin In The Congo And Beyond: The Journey Of BigBlock Datacenter’s Sébastien Gouspillou - Bitcoin Magazine

Companies Buying Bitcoin: An Overlooked Megatrend - Bitwise

El Salvador's tourism thrives amid Bitcoin adoption - Crypto Briefing

SEC charges Robinhood with securities violations, brokerage to pay $45 million penalty - CNBC

4 US Economic Events to Drive Bitcoin Sentiment This Week - Cointime

UK proposes ban on ransomware payments in critical sectors - Cointelegraph

Why Hundreds of Companies Will Buy Bitcoin in 2025 - Bitcoin Magazine

Good Riddance to Gary Gensler - Coindesk

Internal De-Dollarization: Study Finds 52% of Americans Prefer Crypto Over Traditional Assets - Watcher Guru

Hong Kong's ESR, CloudHQ team up for $2 billion data centre campus in Japan - Yahoo Finance

HashKey predicts bitcoin to break through $300,000 in 2025 - The Block

Bitcoin vs. the quantum computer threat: Timeline and solutions (2025–2035) - Cointelegraph

Unknown nation considering Bitcoin as an alternative to traditional bonds, Bitwise CEO reveals - Cryptoslate

Bitcoin Mining in the Nordics w/ Jaran Mellerud - The Mining Pod

Brickken secures $2.5M to expand tokenized assets platform in Europe - Cointelegraph

Crypto Market Today Jan 17: BTC Hits $102K, Traders Eye ETH Options Expiry & Trump Trade - Coingape

Crypto Advisory Council Set to Potentially Include About 24 Industry Leaders - Crypto News